Does Insurance Cover SI Joint Fusion with LinQ?

If you are considering SI joint fusion with LinQ, you may be wondering if insurance will cover the procedure. Insurance can be tough to navigate with different policies, coverages, and requirements. Fortunately, the PainTEQ Patient Access Program is designed to help patients throughout the process and make it as stress-free as possible. The following general overview of how insurance works with SI joint fusions should give you a better idea of what to expect.

What is a Pre-authorization, and Why Do I Need It?

To have an SI joint fusion covered by insurance, you will likely need pre-authorization. A pre-authorization is when your insurance company reviews your medical history and treatment plan to see if a particular procedure is medically necessary.

The pre-authorization process may vary depending on your insurance company, but you will need to submit information about your SI joint pain and treatment history. This may include but is not limited to medical records, X-rays, or MRIs. Working with your physician to gather all the necessary information to submit your case to the insurance company may increase the chances of getting pre-authorization. Pre-authorization is essential in getting your procedure covered by insurance, and the PainTEQ Patient Access Program is here to assist patients every step of the way.

How Long Does the Pre-authorization Process Take?

The pre-authorization process typically takes 3 to 15 days. Once your insurance company has all the necessary information, they will review it and determine whether or not you meet medical necessity to approve your SI joint fusion. While pre-authorization doesn’t necessarily guarantee payment, it is typically a required first step in coverage by your insurance.

Reasons Why Your Case May Be Denied

In some cases, an insurance company may deny pre-authorization for SI joint fusion. There are a few reasons why this might happen. However, being denied initially doesn’t bar you from eventually getting coverage. An appeal may be made to the insurance company to have the decision reversed. Common reasons why your case may be denied include the following:

- Coverage limitations

- Missing clinical documentation

- Inadequate medical necessity

- The claim being made too late

Appealing a Determination Made by an Insurance Company

As mentioned above, even if you were denied at first, you may still be able to use insurance to help mitigate the cost of your SI joint fusion. If you have been denied pre-authorization or coverage for SI joint fusion, you may be able to file an appeal. The appeal process may take an additional 30 to 60 days to come to a determination, and several appeals may be needed to make your case. It is important to have all the documentation from your original pre-authorization request as well as any new information that may help your case when filing an appeal.

The PainTEQ Patient Access Program can help you appeal your case to the insurance company and ensure you have all the necessary documentation. We understand how important it is to get coverage for your procedure, and we will do everything we can to help you throughout the process.

PainTEQ’s Patient Support Team for SI Joint Fusion

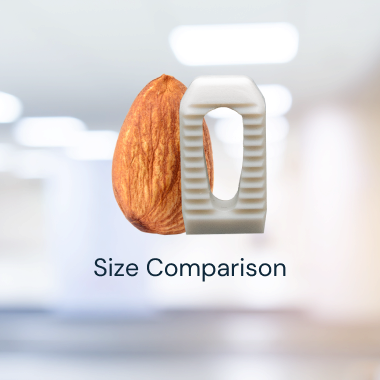

Are you suffering from SI joint dysfunction and are ready to explore your treatment options? The minimally-invasive LinQ SI Joint Stabilization Procedure by PainTEQ may be for you. At PainTEQ, we aim to provide patients with the best possible outcome and experience. Whether you have questions about the procedure, the pre-authorization process, or appealing a denial from your insurance company, our team is here to help. Contact us today and take the first step toward finding relief from your SI joint pain.